Lots of people in the Philippines want fast, hassle-free access to their Social Security System (SSS) info. The My SSS Portal lets users check contributions, apply for benefits or loans, and manage their account online—anytime they want. This comes in handy for anyone hoping to skip the lines and save precious time. The portal works for both members and employers.

It offers features like viewing payment histories, tracking claims, and getting updates about SSS records. Members can also reset their passwords or update personal details with just a few clicks. Learning how to use the My SSS Portal means you can handle your social security needs from home. With a few clear steps, members can register, log in, and take advantage of this online service.

What Is the SSS Portal?

The SSS Portal is the official online hub for SSS members and employers in the Philippines. It makes government social security services way more accessible and helps people manage their SSS records with less stress.

Purpose and Benefits

The SSS Portal gives members and employers a secure, convenient way to handle their SSS accounts. Through the member portal, users can check their contribution history, loan balances, and benefit eligibility whenever they want.

Employers can submit employee reports and post contributions much faster. Both household and regular employers get real-time updates this way. The portal helps members stay in the loop about their account status and notifications. It’s open 24/7, which is great for anyone with a packed schedule.

Key Features

The My.SSS Portal offers several core features. Here’s what users can do online:

- Check monthly contributions

- Apply for salary or calamity loans

- Submit benefit claims (like maternity, sickness, and retirement)

- Update personal information

- Request certifications and forms

Employers can submit reports and payments electronically. This means transactions get posted in real time, and there are fewer mistakes. Members and employers can track their transaction progress easily. The portal uses encrypted logins and regular updates to keep accounts safe.

Notifications and alerts help members stay on top of changes or actions needed. The SSS Website puts all of these tools in one easy-to-use platform.

Accessing the SSS Portal

Using the SSS Portal online gives members a secure way to manage benefits and contributions. You can create an account, log in, and recover credentials right from the My.SSS platform.

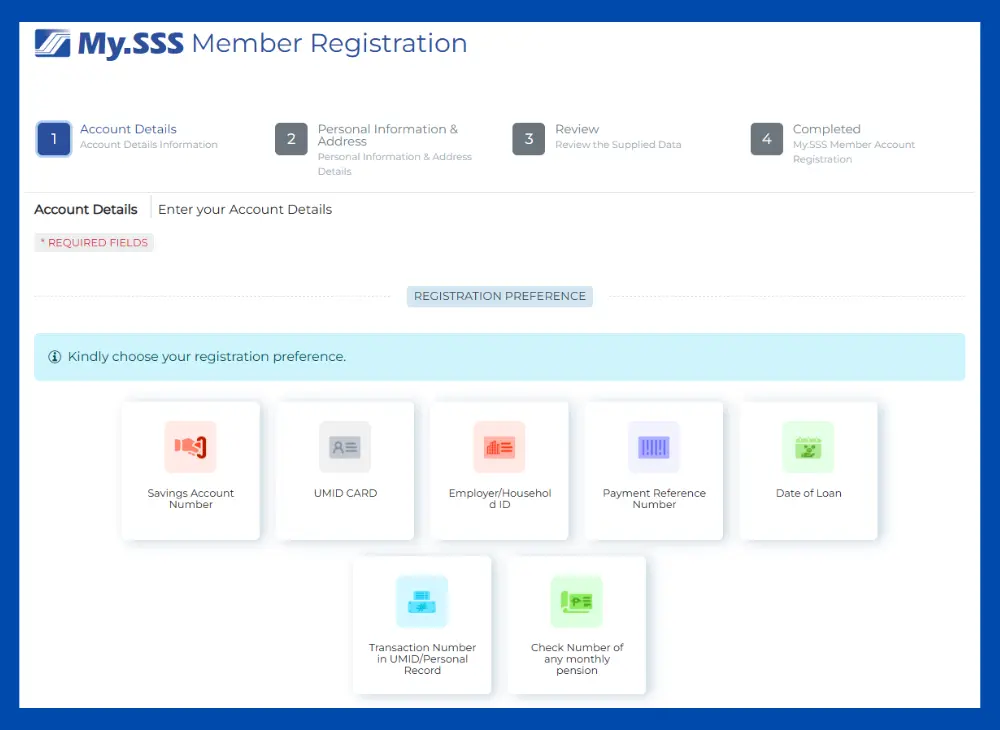

Creating an Account

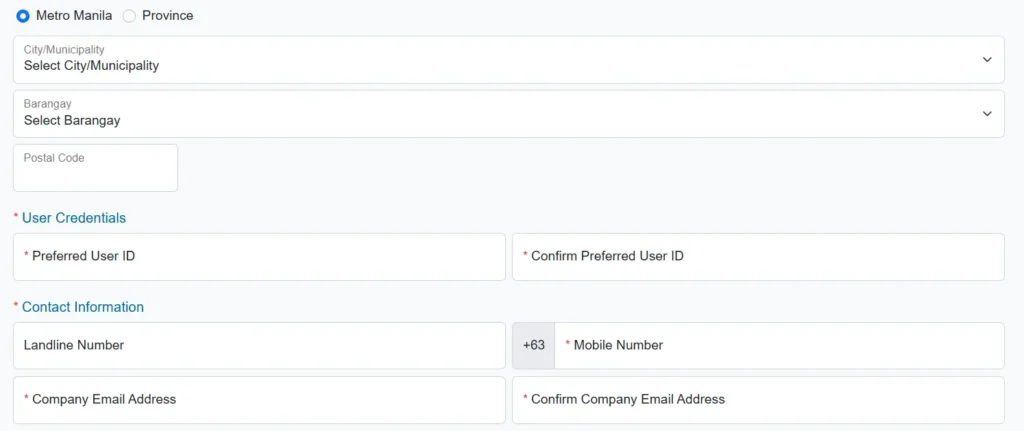

To get started, members need to register for a My.SSS account. Head to the official SSS website and look for “Create Account” or “Register.” You’ll need to enter your SSS number, date of birth, and an email address. Pick a strong password so your account stays protected.

The portal will ask you to set up security questions, too. That’ll come in handy if you ever forget your password.

After submitting your info, you’ll get a confirmation link by email. Click that link to finish registering.

Once verified, you can log in with your user ID and password.

Login Process

To log in, just go to the My.SSS Portal Login Page and enter your user ID and password. You set up your user ID during registration. If you get the credentials right, the system takes you straight to your dashboard. There you can check contributions, file claims, or generate a payment reference number.

Always log out when you’re done to keep your account safe. Don’t share your login details with anyone. Changing your password regularly is a good idea, too.

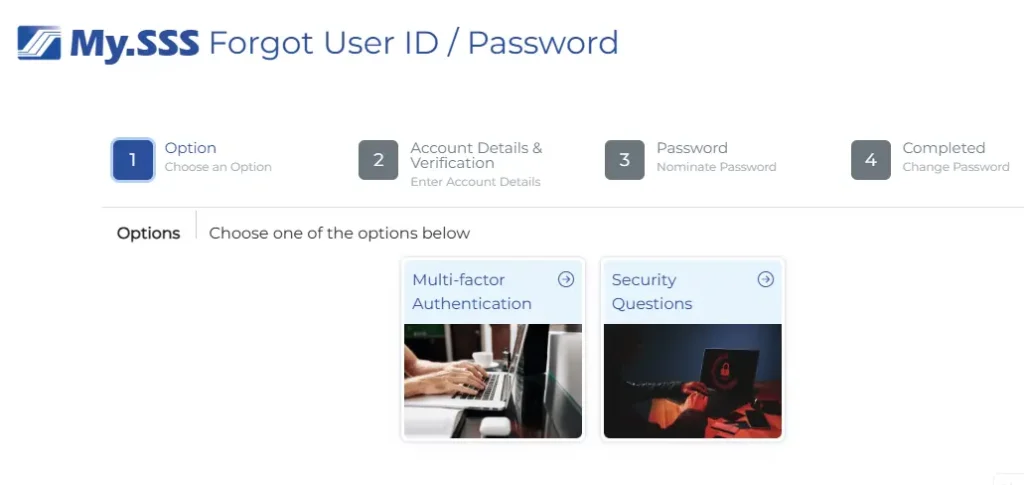

Account Recovery

If you forget your password or user ID, the portal’s recovery feature is there to help. Look for “Forgot Password?” or “Forgot User ID?” on the login page.

Click it, and the system will guide you to submit your registered email or answer your security questions. Once you verify your identity, you can set a new password.

Make sure the new password is unique and tough to guess. If you don’t see the email, check your spam or junk folder.

If you’re still locked out, you can always reach out to SSS customer support for help.

SSS Membership Types

The Social Security System (SSS) has different membership categories for various Filipino workers. Coverage and contribution rules change depending on whether you’re employed, self-employed, or a voluntary member.

Employees

Employees get automatic SSS coverage through compulsory membership. Employers have to register their business and their workers with SSS, and they handle monthly contributions.

Both employer and employee pay a share, but the employer usually covers a bigger chunk. Membership starts on your first day at work.

Benefits include sickness, maternity, disability, retirement, and death coverage. Employees might also claim for unemployment in some cases.

Employers deduct your share from your salary and send it in along with theirs every month. Staying up to date with payments is key for active coverage.

Self-Employed Individuals

Self-employed folks—like freelancers, small business owners, and professionals—can sign up as SSS members. You’ll need documents to prove self-employment, such as a business permit or a professional license.

Self-employed members pay the full contribution themselves, based on their income or declared earnings. Regular payments mean you qualify for all SSS benefits, just like employees.

Self-employed members need to keep payments current. The benefits are the same as for employees, but the responsibility’s all on you.

Voluntary Members

Voluntary members are usually people who used to be employed or self-employed but aren’t earning a steady income anymore. OFWs, separated employees, and non-working spouses can also enroll as voluntary members.

You’ll need to have contributed as an employee or self-employed member before switching to voluntary status. Voluntary members pay their own contributions, choosing an amount within SSS guidelines.

This lets you keep building SSS benefits even without a regular job. Payments can be made online or over the counter, whichever works for you.

Special Coverage Categories

Some groups have their own rules for SSS membership and benefits. These include Overseas Filipino Workers (OFWs), household employers and kasambahay, and non-working spouses.

Overseas Filipino Workers

OFWs must become SSS members by law—whether they work on land or at sea. Membership gives OFWs access to benefits like sickness, maternity, disability, retirement, and death or funeral claims.

You can register online through the My.SSS Portal with a valid passport and other IDs. If you’re not a member yet, fill out the form and submit documents like your employment contract or proof of work abroad.

OFWs pay monthly contributions based on the SSS schedule. Payments are accepted through partner agencies and accredited banks, even from overseas.

Once you meet the minimum contributions, benefits are available. OFWs can track contributions, check benefits, and apply for loans on the portal.

Household Employers and Kasambahay

Household employers must register themselves and their kasambahays with SSS. “Kasambahay” covers domestic helpers like nannies, cooks, and gardeners.

SSS coverage is compulsory for all kasambahays, no matter their work type or length of service. Employers deduct the right amount from the kasambahay’s salary and add their share.

Payments can be made at SSS offices or authorized centers. Both employer and kasambahay can monitor contributions through the portal.

If a kasambahay leaves or changes employers, the employer should report it to SSS. The kasambahay can keep contributing as a self-employed or voluntary member to keep their benefits going.

Non-Working Spouse

A non-working spouse can register as a voluntary SSS member if they’re married to an active SSS contributor. You’ll need a marriage certificate and your spouse’s SSS number for registration.

Contributions are based on the working spouse’s latest monthly salary credit. Payments can be made at SSS offices or partner banks.

Eligible non-working spouses get access to benefits like sickness, maternity, disability, and death, depending on their contributions. If your spouse’s work status changes, you can continue as a voluntary member.

Managing Your Member Account

Managing your SSS portal account matters for keeping your personal info correct and membership details current. Quick online access makes it easy to check your status or make changes when needed.

Updating Personal Information

You can update your personal information right on the SSS portal. Change your address, contact number, email, or civil status as needed.

Keeping these details up to date means you’ll get important notifications about your membership. Log into My.SSS and head to the personal info section to make updates.

Some changes, like name or birthdate, might need supporting documents. Double-check everything before submitting, since mistakes can cause problems with benefits or loans.

The portal sends a notification once changes go through, so watch for a confirmation email or message.

Membership Status

The SSS portal shows your current membership status, including registration type, contribution updates, and whether your account is active. You can also review your payment history and confirm if contributions are posted correctly.

If you spot missing payments or an inactive status, use the portal’s help section or contact customer support. Having this info on hand helps you stay on top of your standing and fix issues fast.

The status page lists your SSS number, membership type (employed, voluntary, self-employed), and any special program enrollments. This way, you can manage your membership without making a trip to an SSS office.

Viewing and Paying SSS Contributions

You can check your SSS contribution online and pay through several secure channels. Staying updated and paying on time helps you avoid penalties and protects your future claims.

Contribution Inquiry

To see your latest SSS contributions, log in to the My.SSS Portal on the official website. The portal shows a table with monthly contribution details, including amounts and covered periods.

You’ll find a summary of all posted contributions, plus info on things like WISP for retirement savings. Employment history, static info, and current loan balances are right there, too.

You can print or download records for your files. The online inquiry makes it easy to confirm that your contributions are complete and up to date.

Payment Channels

There are different ways to pay SSS contributions. You can pay on the SSS website, in the SSS Mobile App, or at partner centers like banks and Bayad Centers.

Employees should check that their employers use the correct PRN (Payment Reference Number) each month. Self-employed and voluntary members can generate a PRN from the portal or mobile app before paying.

Payment status usually updates on the portal shortly after you pay. You can download or print your payment confirmation for your records. Digital channels save time and help you avoid missing deadlines.

Applying for SSS Loans

You can apply for different types of loans through the SSS Portal. Each loan has its own requirements and steps for online application.

Salary Loan Application

The SSS salary loan gives cash to employed, self-employed, or voluntary members. It’s meant for short-term financial needs.

To qualify, you need at least 36 monthly contributions, with 6 posted in the last 12 months before applying.

You apply online through the My.SSS portal or mobile app. Just log in, head to the E-Services tab, and pick “Apply for Salary Loan.”

Choose your loan amount and select a bank account you’ve enrolled in the Disbursement Account Enrollment Module (DAEM). That’s where your funds will go.

Approval and release usually take a few working days. Make sure your account details are updated to avoid any hiccups.

Employees repay through monthly salary deductions. Others can pay online or use payment channels.

Calamity Loan Application

The SSS calamity loan is for members in areas under a state of calamity. It’s there to help when natural disasters hit.

Eligibility requires at least 36 monthly contributions, and you have to live or work in the affected area.

To apply, log in to My.SSS and select “Apply for Calamity Loan” under E-Services. Update your disbursement account in DAEM if you haven’t yet.

Fill out the application, agree to the terms, and wait for approval. Funds go straight to your chosen bank account.

Repayment terms follow SSS rules, and payment options are usually flexible. Always check if the calamity loan program is currently open before applying since it’s only available during official calamity periods.

Accessing SSS Benefits and Claims

The SSS portal lets people check if they qualify for benefits and submit claims for retirement, sickness, or maternity. Online access makes it easier to manage your records and track your coverage.

Benefit Eligibility

SSS offers benefits like sickness, maternity, disability, unemployment, retirement, and death. Each has its own requirements, usually a minimum number of contributions and some specific conditions.

For retirement, you need to be at least 60 and have paid 120 monthly contributions. Sickness benefits require at least three months of contributions in the year before you got sick.

Other benefits, like maternity or unemployment, have their own rules. You can use the SSS portal to see your contribution history and check if you qualify.

It’s easy to see if you need more contributions or if you’re all set for a claim.

Claim Application Process

You can file all SSS claims online through My.SSS. Register on the site and make sure your disbursement account is verified for payments.

The steps can change depending on the benefit, but here’s the usual flow:

- Log in to My.SSS.

- Select the benefit claim you want.

- Fill out the digital form.

- Attach documents like medical certificates or IDs.

- Submit and wait for updates.

The portal updates you on your claim status. You might get alerts by email or see them on your dashboard.

Check that you’ve uploaded all documents to avoid delays. Make sure your banking details match SSS records for smoother transactions.

Employers’ Use of the SSS Portal

Employers use the SSS portal for employee social security requirements in the Philippines. It’s an online system for registration, reporting, and managing contributions.

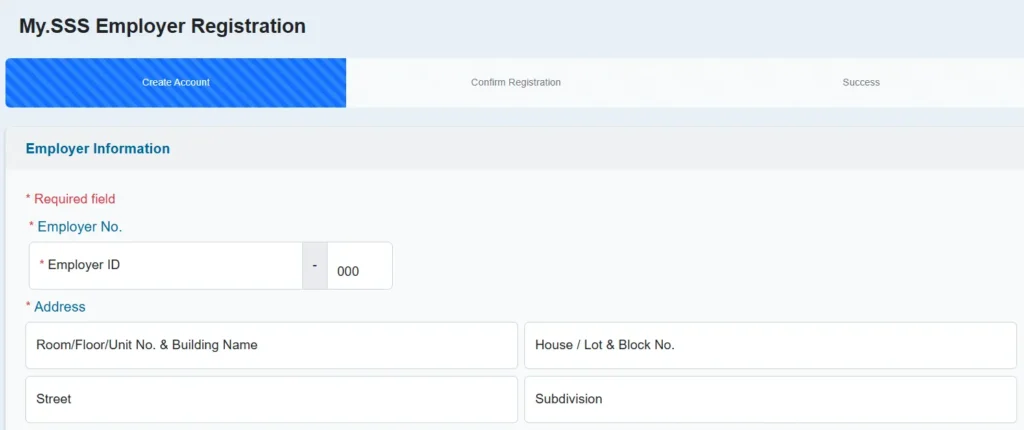

Employer Registration

Employers register with SSS either online or at a branch. You’ll need an SSS portal account before managing employees.

Go to the SSS website, pick the employer option, and fill in your business details. After submitting, SSS gives you portal access.

Set your log-in credentials for secure transactions.

Main requirements for employer registration:

- Business registration documents

- Employer Tax Identification Number (TIN)

- Business address and contact details

- Employee information for initial reporting

Once registered, you can use your log-in details to access the employer portal.

Employee Management

Employers report new hires, update records, and submit contributions through the portal. When you hire someone, just submit their details online.

This updates your official date of coverage (DOC) with SSS. You’re responsible for encoding employee Social Security numbers, managing contributions, and submitting reports.

The portal helps you view payment history, check status, and handle requests. It cuts down on paperwork so you can focus on running your business.

Key features for employee management:

- Enroll or remove employees

- Update employee details

- Submit and monitor contributions

- Generate official SSS reports

You can also handle employee SSS concerns directly online or contact your local branch if needed.

Security and Privacy Settings

The SSS Portal uses strict security to protect member accounts from unauthorized access. Digital tools and good user habits help keep your data safe.

Account Security Tips

1. Create a Strong Password

Make sure your password mixes upper and lowercase letters, numbers, and symbols. Skip personal info like birthdays. And seriously, don’t share your password.

2. Change Password Regularly

Changing your password often lowers the risk of getting hacked. The system might prompt you if something seems off or after a certain time.

3. Enable Two-Factor Authentication (2FA)

The portal now supports TOTP via authenticator apps. This extra step makes it harder for anyone else to get in, even if they know your password.

4. Check for Suspicious Activity

Keep an eye on recent activity and notifications. If you see anything weird, change your password right away and contact SSS support.

| Security Feature | What It Does |

|---|---|

| Strong Password | Prevents easy guessing or brute-force attacks |

| Change Password | Reduces long-term exposure to stolen credentials |

| Two-Factor Authentication | Adds another layer of security |

| Account Activity Monitoring | Lets members spot misuse early |

Keep your devices secure and log out of the SSS Portal after each session. It’s a simple way to keep things private.

Frequently Asked Questions

You can register, view contributions, or reset passwords online. Employers follow a different process to manage company SSS records.