The SSS contribution table 2025 impacts millions of workers, employers, and voluntary members across the Philippines. For 2025, the Social Security System (SSS) has set the contribution rate at 15% of the Monthly Salary Credit (MSC), with employers covering 10% and employees contributing 5%. This update follows the gradual adjustments required by the Social Security Act of 2018.

Understanding the latest SSS contribution table helps everyone know exactly how much to pay each month and what benefits to expect. The table covers employees, employers, household workers, OFWs, and self-employed or voluntary members, so it’s really important for everyone to check the updated rates.

In this guide, we will explain updated rates in simple terms. For the official 2025 SSS Contribution Table PDF, visit the SSS portal.

What Is the SSS Contribution Table?

The SSS Contribution Table lists the monthly contributions for different types of SSS members in the Philippines. It lays out the rates and payment breakdowns so employers, employees, self-employed, and other members can see exactly how much to pay for social security coverage.

Purpose and Importance of the SSS Contribution Table

The main point of the SSS Contribution Table is to help SSS members and employers compute and pay the right amount every month. This table matters for all who are covered by the SSS: employees, employers, self-employed, voluntary members, and OFWs.

It shows both the employee and employer shares, making payments straightforward. By following the table, members keep their social security benefits—like sickness, maternity, retirement, and disability—active and updated.

Missing the right table can cause payment mistakes and lost benefits. That’s why SSS releases updated tables whenever contribution rates change, so everyone can pay legally and properly.

Brief History and Legal Basis

The Social Security System (SSS) started in the Philippines to help workers and their families when they face sickness, retirement, disability, or death. The main law now is Republic Act No. 11199, also called the Social Security Act of 2018.

This law allows updates to SSS policies, benefits, and contributions as needed. The SSS Contribution Table follows these legal requirements, including scheduled changes in rates and coverage.

The table gets reviewed and updated every few years to keep the SSS fund healthy for its members. These changes reflect new laws and the government’s push to make social protection fair for all workers in the Philippines.

Updates for 2025

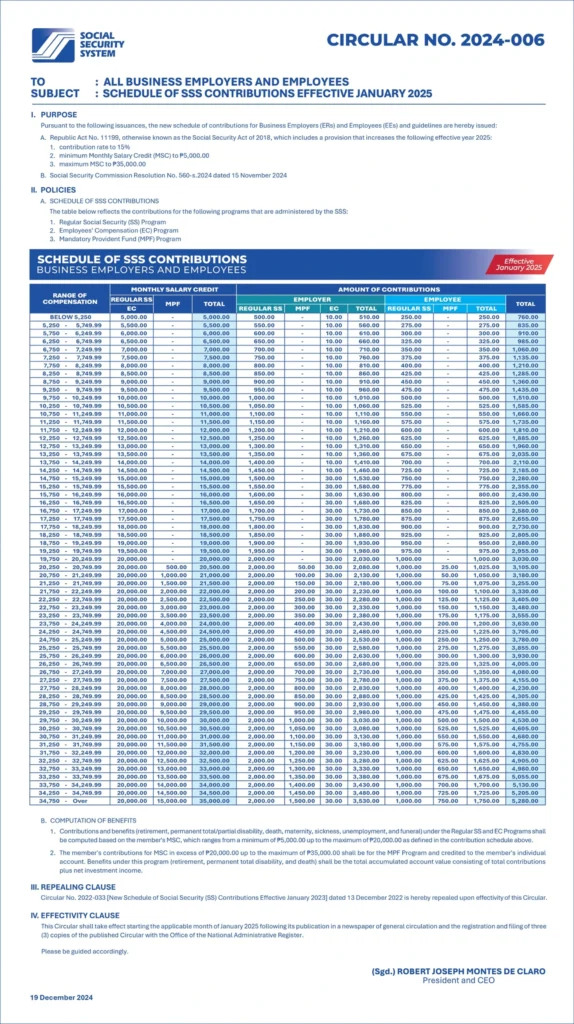

For 2025, the SSS has released an updated Contribution Table, following SSS Circular No. 2024-006. The table now uses a 15% contribution rate based on the Monthly Salary Credit (MSC).

- Employers pay 10%

- Employees pay 5%

The table covers regular employees, employers (ER), self-employed (SE), voluntary members, household employers (HE), non-working spouses, and land-based OFWs.

These changes follow the gradual increase required by the Social Security Act of 2018 (RA 11199). Members need to check the 2025 table to know their correct payment based on salary bracket and membership type.

Overview of SSS Contributions for 2025

SSS contributions in 2025 use new rates and guidelines from the Social Security System. The total contribution for each member depends on their monthly salary and membership type. The system uses salary brackets to figure out how much each member and employer need to pay.

Contribution Rates and Calculation

The standard SSS contribution rate for 2025 is 15% of the Monthly Salary Credit (MSC).

For employed workers, the employee pays 5%, and the employer pays 10%. Self-employed, voluntary members, Overseas Filipino Workers (OFWs), and non-working spouses pay the full 15% themselves.

Monthly contributions depend on salary brackets. The higher the salary, the bigger the monthly contribution. For example:

| Monthly Salary | Total Contribution (15%) |

|---|---|

| ₱10,000 | ₱1,500 |

| ₱20,000 | ₱3,000 |

| ₱30,000 | ₱4,500 |

The maximum salary for calculations is capped, so contributions don’t go higher than the set ceiling.

Breakdown: Employer and Employee Shares

For regular employees, the employer covers 10% of the MSC, while the employee pays 5%.

This split makes SSS membership more affordable for workers. Only 5% comes out of the employee’s paycheck each month, while the employer adds their 10% share.

Self-employed, voluntary members, OFWs, and non-working spouses don’t have an employer to share the cost. They pay the full 15% themselves each month.

Payslips show separate lines for employee and employer contributions, so it’s easy to track payments and updates.

2025 SSS Contribution Table: Salary Brackets and Credits

The SSS Contribution Table sorts members into salary brackets, each with its own monthly salary credit (MSC). Contribution rates and payments depend on where a member’s salary fits in these brackets.

Minimum and Maximum Monthly Salary Credits

The 2025 SSS Contribution Table sets a minimum MSC of ₱5,000 for most members. OFWs have a higher minimum MSC of ₱8,250. The maximum MSC for 2025 is ₱35,000 for everyone.

So, if you earn less than ₱5,000, you’ll still use ₱5,000 as your contribution base (unless you’re an OFW, in which case ₱8,250 applies). If you earn ₱35,000 or more, your contributions are based on that upper limit.

Each salary bracket is defined by a range of monthly salaries. Members match to the nearest bracket according to their actual monthly earnings. The SSS contribution rate for 2025 is 15% of the MSC. Employees contribute 5% and employers cover 10%.

Here’s a sample table for illustration:

| Monthly Salary Range | MSC | Employee Share (5%) | Employer Share (10%) | Total Contribution (15%) |

|---|---|---|---|---|

| ₱5,000 – ₱8,249.99 | ₱5,000 | ₱250 | ₱500 | ₱750 |

| ₱34,750 & up | ₱35,000 | ₱1,750 | ₱3,500 | ₱5,250 |

How to Use the Contribution Table

To use the SSS contribution table, find your gross monthly salary first. Then look for the salary range that covers this amount in the table. The corresponding MSC for that range becomes your base for SSS contributions.

Employees and employers use the rates to figure out their shares. For example, if you earn ₱10,500 per month, you find the closest salary bracket and MSC. The employee pays 5% of the MSC, and the employer pays 10%.

Voluntary and self-employed members use the table in a similar way. They pick the MSC they want, as long as it’s between ₱5,000 and ₱35,000 (or ₱8,250 and ₱35,000 for OFWs). This way, SSS contributions fit their ability to pay and the benefits they want to get.

SSS Contribution Schedule for Different Sectors

SSS contributions in 2025 depend on the member’s sector, job type, and MSC. The rates and payment responsibilities differ for employees, employers, self-employed, voluntary members, and household workers.

Employed Members and Private Sector

Employed individuals in the private sector follow a fixed breakdown for SSS contributions in 2025. The total contribution rate is 15% of the worker’s MSC.

Employees pay 5%, and employers cover 10%. The salary base ranges from a minimum MSC of ₱5,000 to a maximum of ₱35,000.

For a worker with a ₱10,000 MSC, the monthly SSS contribution totals ₱1,500 (₱500 from the employee + ₱1,000 from the employer). The employer also pays a fixed ₱10 EC contribution (for MSC ≤ ₱14,750), which is separate from the 15% SSS share. Note: For MSC ≥ ₱14,750.10, the EC contribution increases to ₱30.

Note: Late EC payments incur a 3% monthly penalty—employers must remit this separately from SSS contributions.

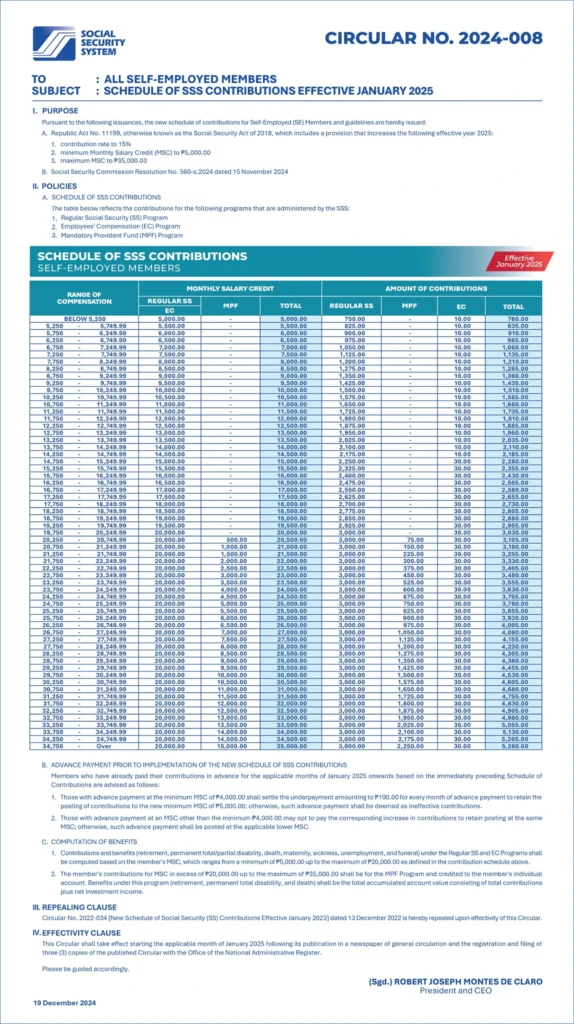

Self-Employed Individuals

Self-employed members pay their entire SSS contribution themselves. In 2025, they follow the same rate as employed members: 15% of their declared MSC.

No employer shares the cost. Self-employed workers pick an MSC between ₱5,000 and ₱35,000. The amount they choose directly affects their monthly contribution and future benefits.

If a self-employed person chooses an MSC of ₱10,000, they pay the full ₱1,500 each month. Payments can be monthly or quarterly. Reporting actual income helps ensure they contribute the right amount and avoid headaches with future claims.

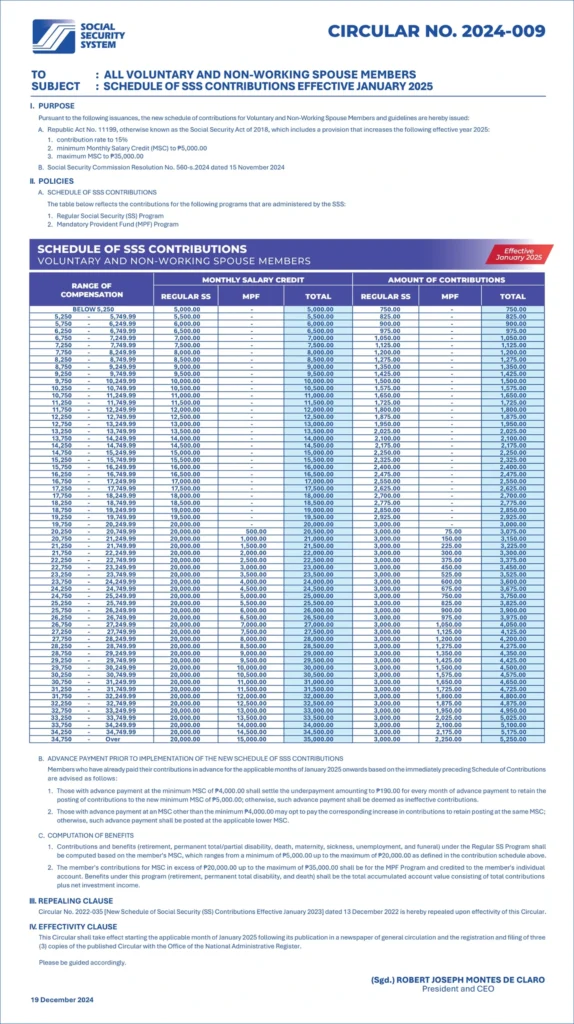

Voluntary Members

Voluntary members—former employed, self-employed, or OFW members—can keep their SSS coverage going. The contribution rate for 2025 is 15% of their chosen MSC.

Like the self-employed, voluntary members pay the full monthly contribution on their own. They can select their MSC in increments (between ₱5,000 and ₱35,000, or ₱8,250 minimum for OFWs). This flexibility is great for freelancers or anyone with an unpredictable income.

Non-working spouses applying as voluntary members base their MSC on their working spouse’s income. Payments can be made monthly or quarterly, through SSS-accredited banks, online channels, or payment centers. Staying up to date keeps benefits active.

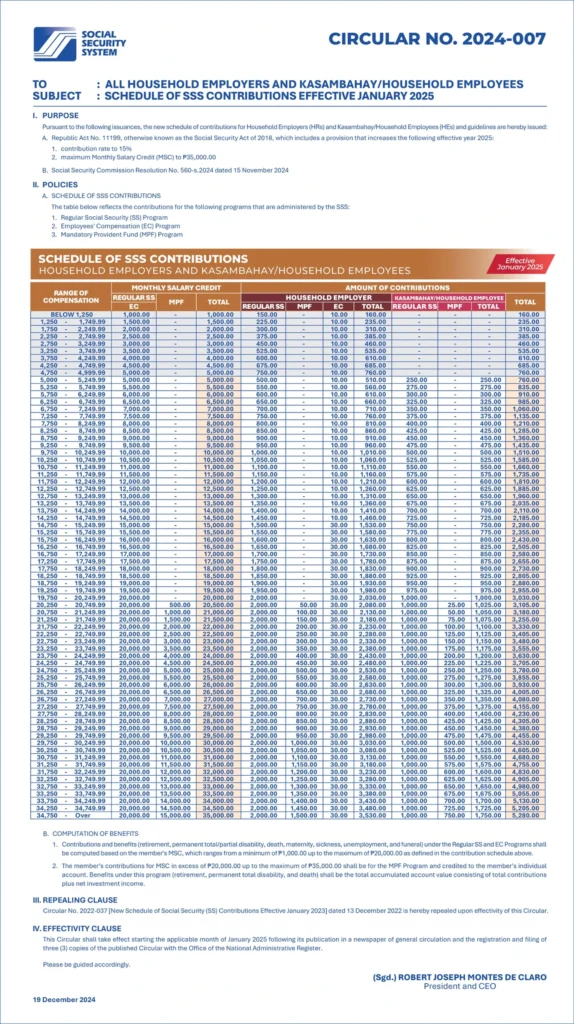

Household Employers and Employees

Household employers have to register with SSS and report their employees, like house helpers or drivers. The 2025 contribution rate is 15% of the employee’s MSC.

The employer pays 10%, and the household employee pays 5%. If the helper’s salary is below the minimum wage, the employer often pays the full contribution.

For a household worker with an MSC of ₱5,000, the employer pays ₱500 and the employee ₱250, so the monthly total is ₱750. Employers must pay on time each month to keep the worker’s benefits active.

Detailed remittance schedules and payment guides are available from SSS. Late payments mean penalties. Filing the right paperwork keeps everyone compliant and workers protected.

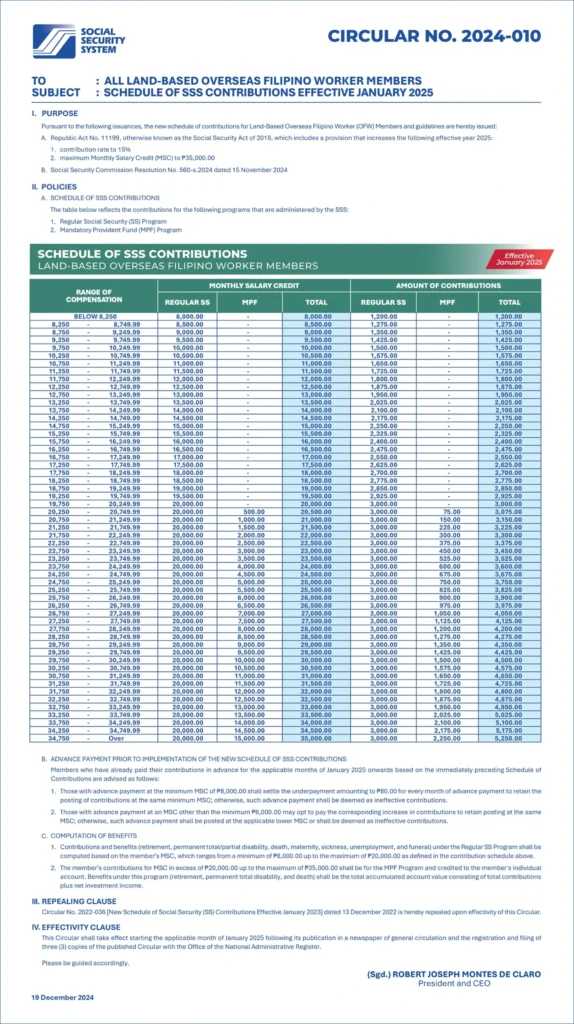

Overseas Filipino Workers and SSS Contribution

Overseas Filipino Workers (OFWs) are required to join the SSS. Their contributions ensure protection for themselves and their families, wherever they work in the world.

Compulsory Coverage and Benefits

All OFWs aged 60 and below must register as SSS members and pay their SSS contributions. This ensures that OFWs keep social security protection even while working overseas.

SSS gives OFWs access to benefits like retirement, disability, sickness, maternity, and death/funeral. OFWs can also apply for SSS salary loan. These are meant to help during emergencies or when returning to the Philippines.

OFWs need an SSS number to register, and new members can apply online. If you already have an SSS number, just update your records to indicate you’re an overseas worker.

Contribution Amounts and Process

For 2025, the minimum monthly salary credit (MSC) for OFWs is ₱8,250. The maximum MSC is ₱35,000. OFWs pay the full 15% of their salary credit as the contribution, since there’s usually no employer counterpart abroad.

Here’s a quick table:

| Monthly Salary Credit | Minimum Contribution | Maximum Contribution |

|---|---|---|

| ₱8,250 | ₱1,238 | |

| ₱35,000 | ₱5,250 |

OFWs can pay at SSS offices, partner agents, or online platforms. Payment schedules are pretty flexible, but staying updated is crucial to keep coverage active. Keep your proof of payment for future claims.

Mandatory Provident Fund and SSS Benefits

The SSS now includes a Mandatory Provident Fund (MPF) along with the usual benefits. This is supposed to give workers a bit more financial protection through savings and extra benefits.

Contribution to the Mandatory Provident Fund

Starting 2025, covered employees and employers contribute to the Workers’ Investment and Savings Program (WISP), a provident fund separate from standard SSS contributions. Self-employed/OFWs may opt in. It’s a long-term savings plan to help people save more for retirement.

For employees, the employer pays 10% and the employee pays 5% of the MSC, totaling 15%. Self-employed, voluntary members, and OFWs pay the full 15% themselves.

Sample Contribution Rates for 2025:

| Type | Contribution Rate |

|---|---|

| Employee (EE) | 5% |

| Employer (ER) | 10% |

| Self-Employed/Voluntary/OFWs | 15% |

Payments to the MPF go into personal savings accounts. These funds earn interest and can be withdrawn at retirement or under certain conditions.

Integration with SSS Benefits

The provident fund adds a savings layer on top of the standard SSS benefits. Members stay eligible for retirement pension, disability benefits, maternity benefits, death benefits, and employee’s compensation.

SSS covers financial support for retirement, work accidents, sickness, or death. Members can also apply for calamity loans and other benefits if needed. The MPF is there to supplement retirement funds and offer more security.

Key Changes and Strengthening Measures for 2025

The 2025 SSS contribution table comes with higher rates and new brackets for the Monthly Salary Credit (MSC). The changes are meant to improve funding and future security for members.

Significant Adjustments Compared to Previous Years

The mandatory SSS contribution rate for 2025 is 15% of the MSC. That’s up from 14% in 2024. Employers now pay 10%, and employees pay 5%.

The minimum MSC for most members is ₱5,000, and the maximum MSC is ₱35,000. Anyone earning above ₱35,000 contributes based on that ceiling.

Quick overview:

| Year | Contribution Rate | Minimum MSC | Maximum MSC |

|---|---|---|---|

| 2024 | 14% | ₱4,000 | ₱30,000 |

| 2025 | 15% | ₱5,000 | ₱35,000 |

These numbers apply to employees, employers, and voluntary or self-employed members. The new table reflects the updated rates and brackets.

Policy Updates and Rationale

The Social Security Act of 2018 requires gradual hikes in SSS contributions every few years. The goal is to strengthen the SSS fund and keep up with growing benefit demands.

Raising the minimum and maximum salary credits means higher earners contribute more. This helps ensure greater security and coverage for everyone. Adjusting the shares between employer and employee spreads the responsibility more evenly.

How to Check and Pay SSS Contributions

SSS members can check and pay monthly contributions through several official tools. Staying on top of payments and checking contributions regularly helps keep records clean and benefits accessible.

Online Platforms and Tools

Members can view their SSS contributions online via the SSS website or the SSS Mobile App.

To use these, you need a registered My.SSS account. Once logged in, hit “Inquiry” then “Contributions” to see a detailed table of payments. The table shows dates, amounts, and the employer/employee breakdowns.

Paying contributions online is also possible. Voluntary and self-employed members can generate a Payment Reference Number (PRN) on the site or app. This PRN is required for payments in banks and payment centers. If you’re employed, your HR usually handles this, but you can still monitor your records online.

Some third-party apps and online banks are also authorized to accept SSS payments. Always check the SSS website for the latest list of accredited partners before paying.

Deadlines and Reminders

Employers must remit payments by the 15th of the following month; self-employed/voluntary members follow a schedule based on their SSS number’s last digit (1–31). Missing deadlines may mean penalties or lost benefits, so don’t let payments slip.

Self-employed and voluntary members have different due dates each month, depending on their assigned number. Employers need to pay both shares every month, following the official schedule.

SSS sends reminders via SMS or email for those who registered online. Checking your contributions often helps catch missed or incorrect payments early. Always keep your payment receipts or confirmations for your records.

Common Questions About the 2025 SSS Contribution Table

Many people wonder who needs to pay SSS contributions, how much, and what to do if something goes wrong. The 2025 SSS Contribution Table lays out the new rates and rules, so it’s important for employees, employers, and voluntary members to get familiar with it.

Eligibility and Coverage

The 2025 SSS Contribution Table covers regular employees and their employers, self-employed individuals, voluntary contributors, and OFWs. Most workers aged 18 to 60 who earn income should pay SSS contributions.

Employers must make sure their employees are covered. This includes domestic workers (kasambahays) and some OFWs. Self-employed people and professionals—like freelancers and small business owners—can enroll as voluntary members.

If you stopped working or are unemployed, you can continue contributing as a voluntary member to keep your SSS benefits. Non-working spouses may register if their spouse is an active SSS member. Proper coverage is needed to claim benefits like sickness, maternity, or retirement.

Typical Scenarios and Examples

People use the SSS Contribution Table based on their monthly salary credit (MSC). For example, if an employee earns ₱20,000 per month, the employer and employee share is set by the 2025 table. Employers deduct the employee’s share and remit both shares to SSS.

A self-employed person selects an MSC based on average monthly income. If you earn ₱15,000 monthly, check the table for the matching MSC and pay the corresponding contribution.

Example Table (for illustration):

| Monthly Salary Credit | Employer Share | Employee Share | Total Contribution |

|---|---|---|---|

| ₱10,000 | ₱1,000 | ₱500 | ₱1,500 |

| ₱20,000 | ₱2,000 | ₱1,000 | ₱3,000 |

This table gives contributors a quick look at how much to pay each month based on income or salary credit.

Troubleshooting Common Issues

Some contributors run into problems with payments or reporting. Missed or late payments can affect benefits. SSS allows late payments but charges a penalty, so paying on time is best.

Posting errors also happen. If your SSS payments don’t show up in your records, keep your receipts and contact your HR or the SSS branch to fix it. Each member type—employee, self-employed, voluntary—has a different deadline, so check the schedule.

Employers also need to double-check reporting and use the correct contribution table. Mistakes in salary credit or remittance can mean unpaid contributions. Members should use the SSS online portal to monitor contributions and catch errors early.

Frequently Asked Questions

The 2025 SSS contribution table includes specific rates and guidelines for self-employed, voluntary, and OFW members. You can find the latest tables in several formats and use different ways to calculate contributions.

How much will I need to contribute as a self-employed individual to the SSS in 2025?

The SSS contribution rate for 2025 is 15% of the Monthly Salary Credit (MSC). Self-employed people pick an MSC based on declared income. The minimum MSC is ₱5,000 (except for OFWs, where it’s ₱8,250), and the maximum is ₱35,000. The monthly contribution equals 15% of your chosen MSC.

Where can I download the SSS contribution table for 2025 in PDF format?

The SSS contribution table for 2025 is on the official SSS website. Go to the “Contribution Table” section and look for the latest PDF. Make sure to get the 2025 version for the current schedule.

What are the contribution rates for voluntary members in the SSS 2025 contribution table?

Voluntary members pay the full 15% contribution based on their chosen Monthly Salary Credit (MSC). The minimum MSC is ₱5,000, and the maximum is ₱35,000.

So, if you pick an MSC of ₱5,000, your monthly contribution comes out to ₱750. It’s pretty straightforward, but always double-check your chosen MSC to avoid surprises.

Is there an Excel version of the SSS contribution table for the Philippines available for 2025?

Most of the time, the official SSS website only puts out the tables in PDF format. Some blogs or finance pages might offer Excel versions, but they’re not official.

If you really need it in Excel, you’ll probably have to convert the PDF yourself or type the numbers in by hand.

How can OFWs compute their SSS contributions using the 2025 contribution table?

OFWs also pay the full 15% themselves, but their minimum MSC is a bit higher at ₱8,250. To figure out your monthly contribution, just pick your MSC and multiply it by 15%.

For example, an OFW with the minimum MSC of ₱8,250 pays ₱1,237.50 monthly (15% of ₱8,250). It’s not complicated, but the higher minimum is something to watch out for.

Is there an online calculator for the 2025 SSS contributions?

Yes, the official SSS website offers an online contribution calculator. Just enter your Monthly Salary Credit (MSC), and it’ll show your monthly SSS contribution for 2025.

You don’t even need to log in—the tool’s open to everyone.